10 Easy Facts About Empower Rental Group Shown

Table of ContentsEmpower Rental Group for DummiesThe Main Principles Of Empower Rental Group Excitement About Empower Rental GroupA Biased View of Empower Rental GroupExcitement About Empower Rental GroupIndicators on Empower Rental Group You Should Know

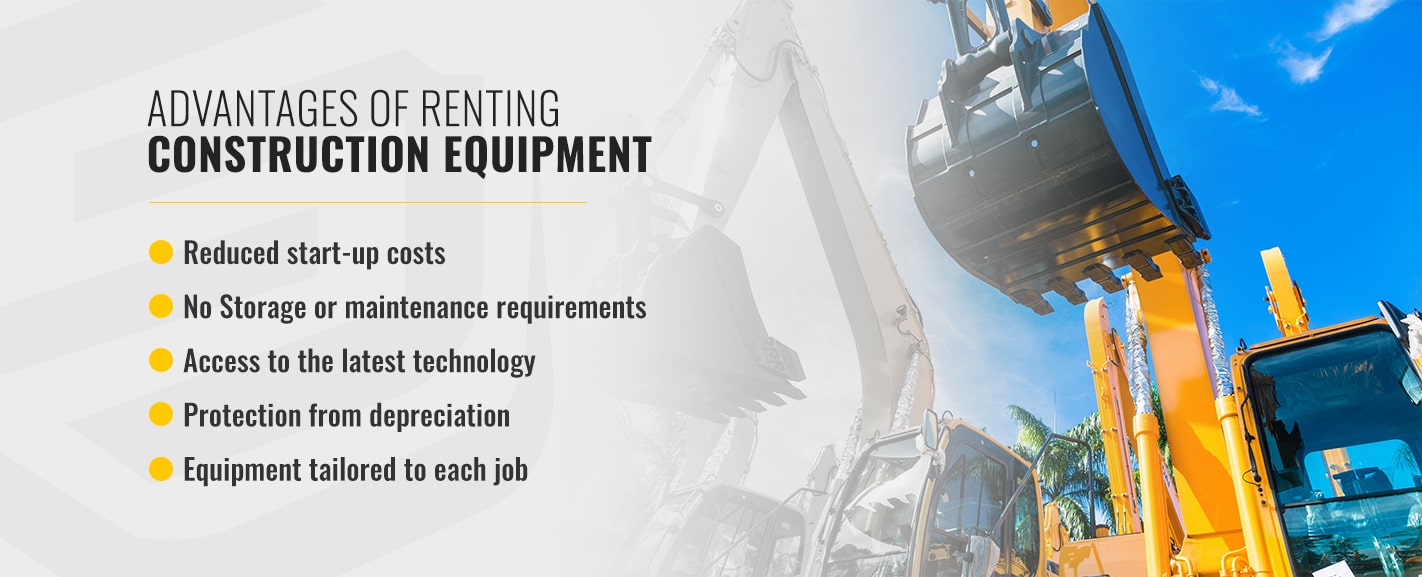

Take into consideration the primary factors that will help you decide to purchase or lease your building devices. dozer rental. Your current financial state The sources and skills available within your company for stock control and fleet administration The prices linked with acquiring and just how they contrast to renting Your requirement to have equipment that's available at a moment's notice If the owned or leased devices will be used for the proper size of time The most significant choosing aspect behind renting out or purchasing is just how typically and in what manner the hefty equipment is utilizedWith the various usages for the multitude of building devices products there will likely be a few makers where it's not as clear whether leasing is the very best option monetarily or purchasing will offer you much better returns over time. By doing a couple of straightforward estimations, you can have a respectable concept of whether it's best to rent out construction equipment or if you'll obtain one of the most profit from purchasing your devices.

The Best Strategy To Use For Empower Rental Group

There are a variety of other variables to consider that will certainly enter play, yet if your organization uses a certain item of equipment most days and for the long-term, then it's most likely very easy to establish that an acquisition is your ideal method to go. While the nature of future tasks might transform you can compute a best guess on your usage price from current usage and projected projects.

We'll speak about a telehandler for this example: Take a look at using the telehandler for the past 3 months and get the number of complete days the telehandler has actually been made use of (if it just wound up obtaining previously owned component of a day, then include the parts as much as make the matching of a full day) for our example we'll claim it was made use of 45 days.

Our Empower Rental Group Ideas

The usage rate is 68% (45 split by 66 equates to 0.6818 multiplied by 100 to get a percent of 68). There's nothing incorrect with projecting use in the future to have an ideal hunch at your future application price, particularly if you have some proposal prospects that you have a likelihood of getting or have actually predicted projects.

If your usage rate is 60% or over, buying is generally the most effective choice. If your utilization rate is between 40% and 60%, after that you'll desire to consider how the various other factors associate to your business and consider all the advantages and disadvantages of possessing and renting (https://macro.market/company/empower-rental-group-26). If your use rate is listed below 40%, leasing is typically the very best choice

You'll constantly have the equipment available which will be excellent for existing tasks and also permit you to with confidence bid on projects without the problem of protecting the devices required for the task. You will have the ability to capitalize on the substantial tax deductions from the initial acquisition and the yearly prices connected to insurance coverage, devaluation, funding interest repayments, fixings and maintenance expenses and all the added tax obligation paid on all these linked costs.

Some Of Empower Rental Group

You can count on a resale value for your equipment, particularly if your company suches as to cycle in brand-new tools with upgraded modern technology (https://www.brownbook.net/business/52924353/empower-rental-group/). When thinking about the resale value, take into account the brand names and versions that hold their value much better than others, such as the reliable line of Feline devices, so you can realize the highest resale value possible

The obvious is having the appropriate capital to purchase and this is probably the top concern of every business proprietor - rental company near me. Also if there is resources or credit available to make a significant acquisition, nobody intends to be getting devices that is underutilized. Unpredictability has a tendency to be the norm in the building and construction industry and it's challenging to really make an informed decision about feasible projects 2 to 5 years in the future, which is what you require to consider when purchasing that must still be benefiting your profits five years down the road

The Greatest Guide To Empower Rental Group

While there are a variety of tax reductions from the acquisition of new devices, leasing expenses are additionally an audit reduction which can commonly be handed down directly to the client or as a basic overhead. They give a clear number to help estimate the exact price of devices usage for a job.

Little Known Questions About Empower Rental Group.

You can contract out equipment management, which is a viable choice for lots of firms that have located buying to be the best option yet dislike the added job of equipment monitoring. As you're considering these benefits and drawbacks of purchasing building and construction equipment, discover how they fit with the way you work now and how you see your company five or even ten years later on.